UFA Default Risk Index: Both Risk and Uncertainty Rising

Winter 2025

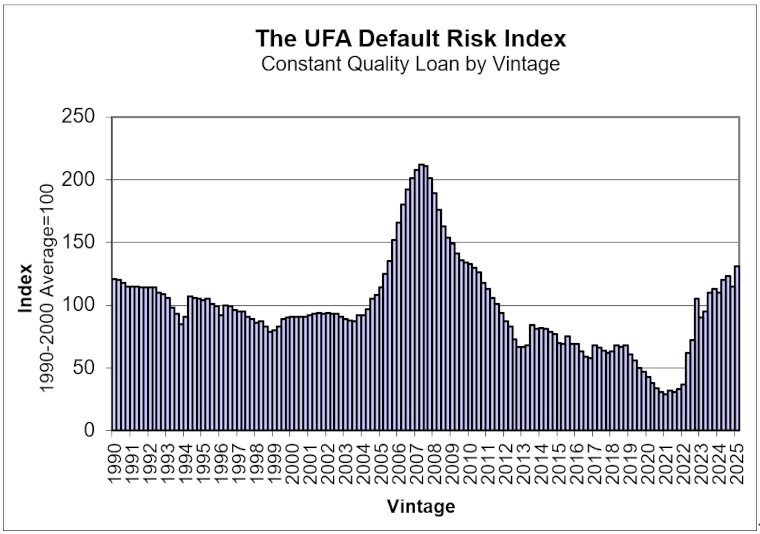

The UFA Default Risk Index for the first quarter of 2025 has risen sixteen points from its fourth quarter 2024 level. The Index rose to 131 from last quarter’s revised 115 in our baseline scenario. Under current economic conditions, investors and lenders should expect defaults on loans currently being originated to be 31% higher than the average of similar loans originated in the 1990s, due solely to the local and national economic environment. That’s a key finding of the latest UFA Mortgage Report™ by University Financial Associates of Ann Arbor, Michigan.

“Despite the strength in the aggregate economy, UFA's metrics for housing and mortgage markets continue to erode, with the UFA Default Risk Index for defaults over the life of a loan originated today trending irregularly higher. Similarly, UFA's 5-year real house price forecasts have also declined. On a short-term basis very few metro areas have an excess supply of housing for sale; therefore, significant real price declines are unlikely in the near term,” said Dennis Capozza, who is Professor Emeritus of Finance in the Ross School of Business at the University of Michigan, and a founding principal of UFA. “Mortgage rates hovering around 7% and affordability metrics at low (unaffordable) levels will limit the prospects for real house price growth. Indeed, real house price growth has fallen from stratospheric levels a few years ago to more sustainable levels currently. The "lock-in" effect arising from so many households holding low-rate mortgages will continue to limit the supply of existing homes for sale for some time. Asset prices, including housing, are high by historical standards and vulnerable to an economic downturn. The president is promoting radical cuts to federal employment and large increases in tariffs. Either or both policy changes could become a trigger event that initiates readjustment.”

The UFA Default Risk Index measures the risk of default on newly originated mortgages. UFA’s analysis is based on a ‘constant-quality’ loan, that is, a loan with the same borrower, loan and collateral characteristics. The index reflects only the changes in current and expected future economic conditions, which are less favorable currently than in prior years.

Each quarter UFA evaluates economic conditions in the United States and assesses how these conditions will impact expected future defaults, prepayments, loss recoveries and loan values for nonprime loans. A number of factors affect the expected defaults on a constant-quality loan. Most important are worsening economic conditions. A recession causes an erosion of both borrower and collateral performance. Borrowers are more likely to be subjected to a financial shock such as unemployment, and if shocked, will be less able to withstand the shock. Fed easing of interest rates has the opposite effect.

UFA’s pioneering mortgage analysis has successfully predicted problems in the mortgage market well in advance including the increased defaults in Southern California in the mid-90s and the recent national mortgage crisis. Its predictions are based on an extensive analysis of local economic conditions in each state and the relationship of those conditions to loan performance. The historical record of millions of mortgage loans is studied each quarter to assess the vulnerability of each state to loan losses and prepayments. The detailed analysis of each state – including best and worst places to lend – is available in the UFA Mortgage Report, published on a quarterly basis.