Powerful Tools to Increase Profitability and Manage Risk

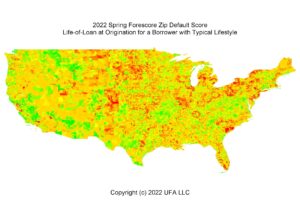

ForeScore™ ZIP Default

ForeScore™ ZIP Default

ForeScore™ ZIP Default takes your credit evaluation to a whole new level. ForeScore™ ZIP Default is usually the second or third most important variable in credit analysis, similar in impact to credit and loan-to-value.

ForeScore™ ZIP Default takes your credit evaluation to a whole new level. ForeScore™ ZIP Default is usually the second or third most important variable in credit analysis, similar in impact to credit and loan-to-value.

How It Works UFA uses large loan datasets to assess the location effects on loan performance of future economic conditions, demographics, environmental conditions, and lifestyle variables.

For more information on how the ForeScore™ tools can help your organization, please contact:

University Financial Associates LLC

Email: [email protected]

Phone: (734) 995-7271

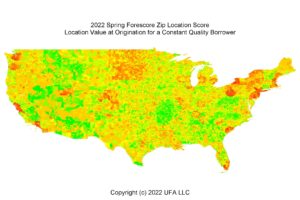

ForeScore™ ZIP Value

ForeScore™ ZIP Value

ForeScore™ ZIP Value takes your loan and pool valuation to an amazing level. The cash flow estimates in ForeScore™ ZIP Value enable you to determine the differences in profitability in each location.

ForeScore™ ZIP Value takes your loan and pool valuation to an amazing level. The cash flow estimates in ForeScore™ ZIP Value enable you to determine the differences in profitability in each location.

How It Works UFA forecasts the future cash flows on a loan based on economic conditions, demographics, environmental conditions, and lifestyle variables. The future cash flows on a loan when combined with the current cost of funds provide the differences in the profitability of a loan at each location. On any given date, these profitability differences can be twenty percent of loan value. Between origination dates profitability can vary by even more... up to fifty percent of loan value!

For more information on how the ForeScore™ tools can help your organization, please contact:

University Financial Associates LLC

Email: [email protected]

Phone: (734) 995-7271

ForeScore™ System Components

The ForeScore™ Risk Analyzer

The ForeScore™ Risk Analyzer is the most accurate way to set loss reserves and pool performance expectations. This powerful tool helps manage economic risks proactively. The ForeScore™ Risk Analyzer takes loan information and combines it with the regional economic data and state-of-the-art analysis provided by UFA. The performance of each loan or pool of loans is simulated under a realistic range of economic conditions. The outputs from the analysis are the expected static pool cumulative losses for the pool as well as annual loss expectations under the specified economic conditions. The value at risk can be determined by simulation methods over likely states of the world.

The ForeScore™ Risk Analyzer is the most accurate way to set loss reserves and pool performance expectations. This powerful tool helps manage economic risks proactively. The ForeScore™ Risk Analyzer takes loan information and combines it with the regional economic data and state-of-the-art analysis provided by UFA. The performance of each loan or pool of loans is simulated under a realistic range of economic conditions. The outputs from the analysis are the expected static pool cumulative losses for the pool as well as annual loss expectations under the specified economic conditions. The value at risk can be determined by simulation methods over likely states of the world.

This tool is invaluable for securitizers who can use it to generate pool "curves" and pool performance projections. When coupled with a bond model, retained tranches like IO strips or residuals can be valued under a variety of economic scenarios. Risk analyzer is now available for both auto and mortgage loans.

For more information on how the ForeScore™ tools can help your organization, please contact:

University Financial Associates LLC

Email: [email protected]

Phone: (734) 995-7271

The ForeScore™ Loan Analyzer

The ForeScore™ Loan Analyzer is UFA’s decisioning tool. The Loan Analyzer receives loan data from a lender’s origination system and processes the loan information with UFA’s economics data and analysis. ForeScore can return either an automated decision to the origination system or a detailed risk analysis of the prospective loan for evaluation by an underwriter. The analysis returned includes expected defaults, prepayments and expected static pool losses as well as an analysis of the borrower, the collateral, the product structure and the economic prospects for the specific location. Only ForeScore provides you such insightful analysis and deep understanding of your loan applications.

The ForeScore™ Loan Analyzer is UFA’s decisioning tool. The Loan Analyzer receives loan data from a lender’s origination system and processes the loan information with UFA’s economics data and analysis. ForeScore can return either an automated decision to the origination system or a detailed risk analysis of the prospective loan for evaluation by an underwriter. The analysis returned includes expected defaults, prepayments and expected static pool losses as well as an analysis of the borrower, the collateral, the product structure and the economic prospects for the specific location. Only ForeScore provides you such insightful analysis and deep understanding of your loan applications.

Most important, however, is the ValueScore™, which measures the profitability of each loan based on monthly cash flows and costs. The ValueScore allows the underwriter to not only accept and reject loans but also restructure marginal loans for profitability. Now available for both auto and mortgage loans.

For more information on how the ForeScore tools can help your organization, please contact:

University Financial Associates LLC

Email: [email protected]

Phone: (734) 995-7271

The ForeScore™ Portfolio Analyzer

The ForeScore™ Portfolio Analyzer is designed to assist lenders with profitability analysis, benchmarking, product pricing, product design and marketing. ForeScore Portfolio Analyzer is a powerful and versatile operations management tool that makes analysis of a loan portfolio simple, fast and easy. Loans can be grouped by segment (e.g., by pricing cell, by location, by originator, by manager, etc.) and analyzed in detail. The expected performance of each group can be calculated and compared. For example, a lender might find that loans from one originator or channel are more profitable than another. Strategies can then be devised to improve poor performers and reward the best performers. Now available for both auto and mortgage loans.

The ForeScore™ Portfolio Analyzer is designed to assist lenders with profitability analysis, benchmarking, product pricing, product design and marketing. ForeScore Portfolio Analyzer is a powerful and versatile operations management tool that makes analysis of a loan portfolio simple, fast and easy. Loans can be grouped by segment (e.g., by pricing cell, by location, by originator, by manager, etc.) and analyzed in detail. The expected performance of each group can be calculated and compared. For example, a lender might find that loans from one originator or channel are more profitable than another. Strategies can then be devised to improve poor performers and reward the best performers. Now available for both auto and mortgage loans.

For more information on how the ForeScore tools can help your organization, please contact:

University Financial Associates LLC

Email: [email protected]

Phone: (734) 995-7271

The ForeScore™ Suite

The ForeScore™ Suite is a powerful set of tools that make it possible for lenders to dramatically increase profits while carefully controlling risks and costs.

Using the ForeScore™ system allows lenders to:

- Increase the proportion of profitable loans and confidently buy deeper

- Gain a competitive advantage over companies that use traditional risk-assessment tools

- Identify the appropriate interest rate and loan terms that make deals profitable

- Automate processes and reduce costs

- Understand and control macroeconomic risks like unemployment and interest rates

- Understand and manage local economic risks that affect the borrower and the collateral

- Risk-price loans to increase volume and profits

- Design products that increase volume and profits

-

Understand prepayment risks and design strategies for

customer retention - Address regulatory auditing needs including value at risk

Underlying the ForeScore™ system is a unique approach to loan analysis that evaluates not only borrower credit but also the product structure, the collateral, and the local economic conditions. The approach is illustrated below.

This comprehensive approach considers all four elements of loan value and greatly increases a lender's ability to recover profitable loans from the pool of applicants. Loan volume can be increased even while holding the expected defaults constant. Large "swap sets" are uncovered that dramatically increase profits